Shopify Inc. (NYSE: SHOP) is a Canadian e-commerce company that provides a platform for businesses to create their own online stores. The company was founded in 2006 and has since grown to become a leading provider of e-commerce solutions. Shopify’s stock has been on a tear over the past few years, with the company’s shares more than tripling in value over the past two years. In this article, we will explore why Shopify stock is a top pick for growth investors.

1. Strong Financial Performance Shopify has a history of strong financial performance, with its revenue growing at an average annual rate of 68% over the past five years. The company’s revenue for 2020 was $2.93 billion, representing a 86% increase over the previous year. Shopify’s gross merchandise volume (GMV) – the total value of products sold through its platform – was $119.6 billion in 2020, up 96% from 2019. This impressive growth has been driven by the company’s ability to attract new merchants and retain existing ones. As of December 31, 2020, Shopify had over 1.7 million businesses in more than 175 countries using its platform.

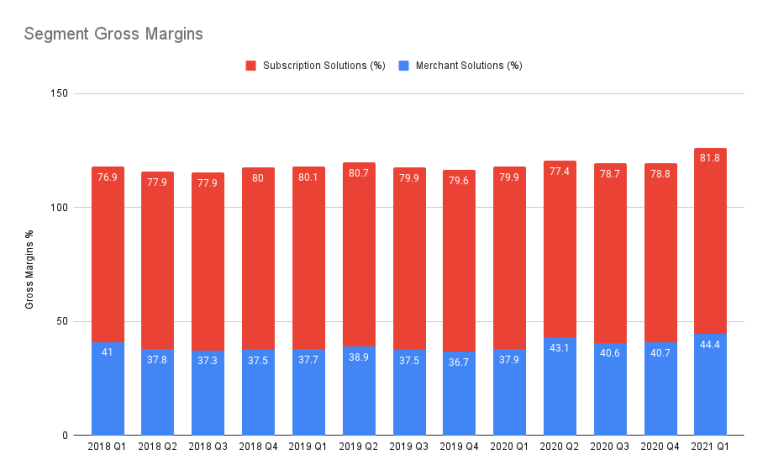

2. Diversified Revenue Streams Shopify’s revenue streams are well diversified, with the company earning revenue from various sources. Its subscription solutions revenue, which includes monthly subscription fees from merchants, grew by 41% in 2020, while its merchant solutions revenue, which includes fees from payment processing and other services, grew by 117%. This diversification of revenue streams helps to mitigate the risk of over-reliance on any one revenue source.

3. Increasing Adoption of E-Commerce The COVID-19 pandemic has accelerated the shift towards e-commerce, with more consumers shopping online than ever before. This trend has benefited companies like Shopify, which provide e-commerce solutions to businesses. According to eMarketer, global e-commerce sales are expected to reach $5.4 trillion by 2022, up from $3.5 trillion in 2019. This represents a huge opportunity for Shopify, which is well positioned to benefit from the growing e-commerce market.

4. Constant Innovation Shopify is a company that is constantly innovating, with a strong focus on improving its platform and adding new features. In 2020, the company launched a number of new products and services, including a new fulfillment network and a new point-of-sale system. These new offerings have helped to attract new merchants to the platform and provide existing merchants with additional services, which in turn has driven revenue growth.

5. Strong Brand and Reputation Shopify has built a strong brand and reputation in the e-commerce industry, with many merchants citing the platform’s ease of use and reliability as key factors in their decision to use Shopify. The company has also received numerous awards and recognition for its platform, including being named the #1 e-commerce platform by G2 Crowd for the past two years. This strong brand and reputation have helped to attract new merchants to the platform and retain existing ones.

Conclusion In summary, Shopify is a company with a history of strong financial performance, diversified revenue streams, and constant innovation. The increasing adoption of e-commerce and Shopify’s strong brand and reputation make it a top pick for growth investors. While the company’s valuation may be high, its potential for continued growth in the e-commerce market makes it a compelling investment opportunity for those willing to hold for the long term.